There is a backlog of ideas for future improvements to Tageba. In the near term, I plan a few things:

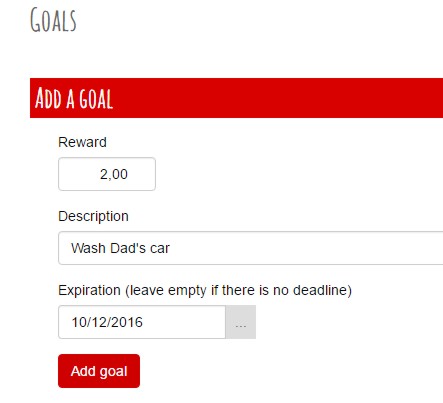

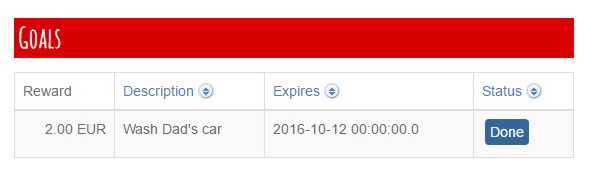

The most important is an incentives system, where parents can set up certain goals and assign a (monetary) award to them. Say, you want to motivate your kid to keep their room tidy or help with the chores. With this feature, you can set up these goals, and once you check that a goal is reached, the associated reward will automatically be deposited into your kid’s account.

This creates not just a very immediate positive feedback, but also allows your child to see the long-term effects of their actions.

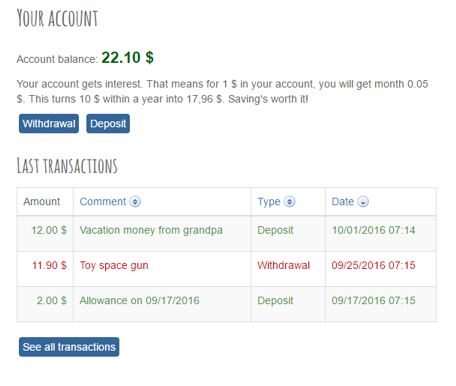

A related new feature will be one-time automated deposits and withdrawals. Say, you want to give money to your child, but only after a certain date (e.g. because you want them to spend some extra money only after a difficult test in school has gone by). In this case, this is not a regular, recurring deposit, like an allowance. With this feature, you can set up such things and decide whether your child can see the upcoming event beforehand or not.

And I plan to make the whole allowance mechanism more abstract. It will be turned into a general system of standing orders that you can fine-tune with specific repeat periods and conditions.

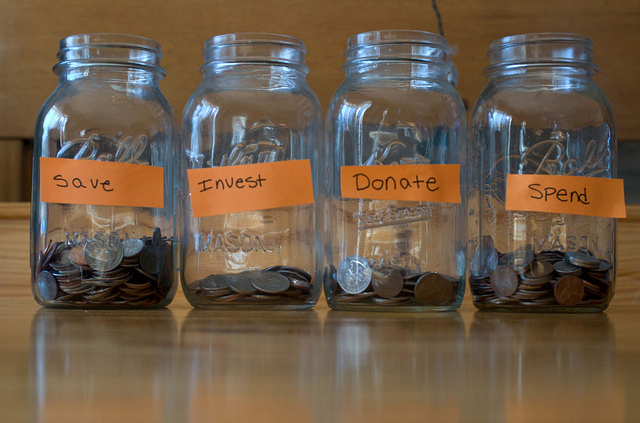

Finally, I plan to incorporate goals and ‘buckets’ you and your kid can set up for saving money. For example, your kid may want to buy an expensive toy which currently is out of their monetary reach. They can set up that toy and its price as a goal, and see daily how close they are to reaching that goal. And you and your kids can set up buckets which will receive a certain percentage of incoming money.

For instance, say your kid wants to donate some money to a good cause. Together you decide that 10% of their income should go towards charity. With Tageba, you will be able to allocate 10% of all money that goes into their account to this ‘bucket’. The money will be protected from withdrawal, and will only be available for the specific purpose it was allocated for (checked by you upon withdrawal).

That’s it for today’s back log. You have more ideas for future features and improvements? Great – let me know via the contact form, and I will be very happy to hear from you. And to keep up-to-date with upcoming features, you can subscribe to the newsletter.